how much is inheritance tax in georgia

If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value. All inheritance are exempt in the State of Georgia.

Wills Attorneys In Savannah Georgia Smith Barid Llc Assist Clients With Ensuring The Smooth Handling Of T Last Will And Testament Will And Testament Mocking

Among the 3780 estates that owe any tax the effective tax rate that is the percentage of the estates value that is paid in taxes is 166 percent on average.

. Due to the high limit many estates are. Georgia law is similar to federal law. If the total Estate asset property cash etc is over 5430000 it is subject to the.

No estate tax or inheritance tax. After any available exemption you could owe 18 to 40 percent in taxes depending on the taxable amount. Inheritance - T-20 Affidavit of Inheritance required.

There are NO Georgia Inheritance Tax. Your average tax rate is 1198 and your marginal tax rate is 22. If you make 70000 a year living in the region of Georgia USA you will be taxed 11993.

No estate tax or inheritance tax Hawaii. The top estate tax rate is 16 percent exemption threshold. As of 2021 the six states that charge an inheritance tax are.

Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth. Georgians are only accountable for federally-mandated estate taxesin. Under federal tax law estates with fewer than approximately 5 million in assets are not subject to estate taxes.

Who has to pay. For 2020 the estate tax exemption is set at 1158 million for. However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206.

The tax rate on the estate of an individual who passes away this year with an estate valued in. Inheritance tax rates differ by the state. Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax.

This marginal tax rate means that. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. As of 2014 Georgia does not have an estate tax either.

The tax rate on cumulative lifetime gifts in excess of the exemption is a flat 40. The effective rate state-wide comes to 0957 which costs the average Georgian 155130 a year based on the median home value in the state of 157800. Estate and gift taxes the.

These states have an inheritance tax. State inheritance tax rates range from 1 up to 16.

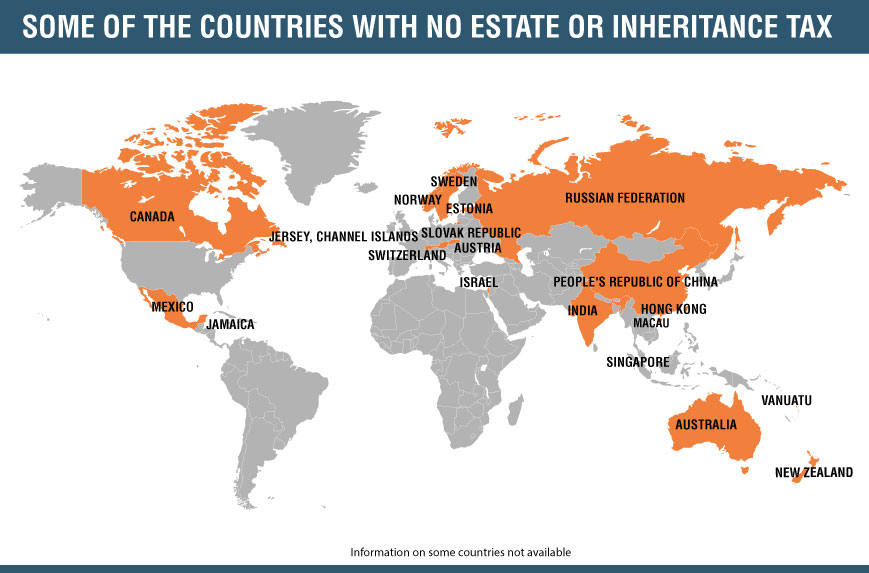

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Property Investment Financial Planning Inheritance Tax Ltd Company Versus Private Personal Ownership Anyone Inheritance Tax Investment Property Inheritance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax Here S Who Pays And In Which States Bankrate

Inheritance Tax Here S Who Pays And In Which States Bankrate

What Is Inheritance Tax Who Pays How Much Sydney Wills Lawyer

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Georgia Estate Tax Everything You Need To Know Smartasset

17 States With Estate Taxes Or Inheritance Taxes Inheritance Tax Estate Tax Inheritance

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Inheritance Taxation In Oecd Countries En Oecd

Georgia Estate Tax Everything You Need To Know Smartasset

What Is Inheritance Tax Probate Advance

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Center For State Tax Policy Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Real Estate 101 What Is Inheritance Tax And Estate Tax What S The Difference Philrep Realty Corporation